Identity theft is a serious problem that affects millions of Americans every year, and California is no exception. According to the Federal Trade Commission, California had the highest number of reported identity theft cases in the country in 2020, with over 147,000 complaints filed.

One of the most common forms of identity theft is credit identity theft, which occurs when someone uses your personal information to open new credit accounts or make unauthorized charges on your existing accounts.

While credit identity theft can be a frustrating and stressful experience on its own, it can also lead to more serious consequences, including debt collection.

In this blog, we'll explore how credit identity theft can result in debt collection in California and what you can do to protect yourself and your finances.

What is Credit Identity Theft?

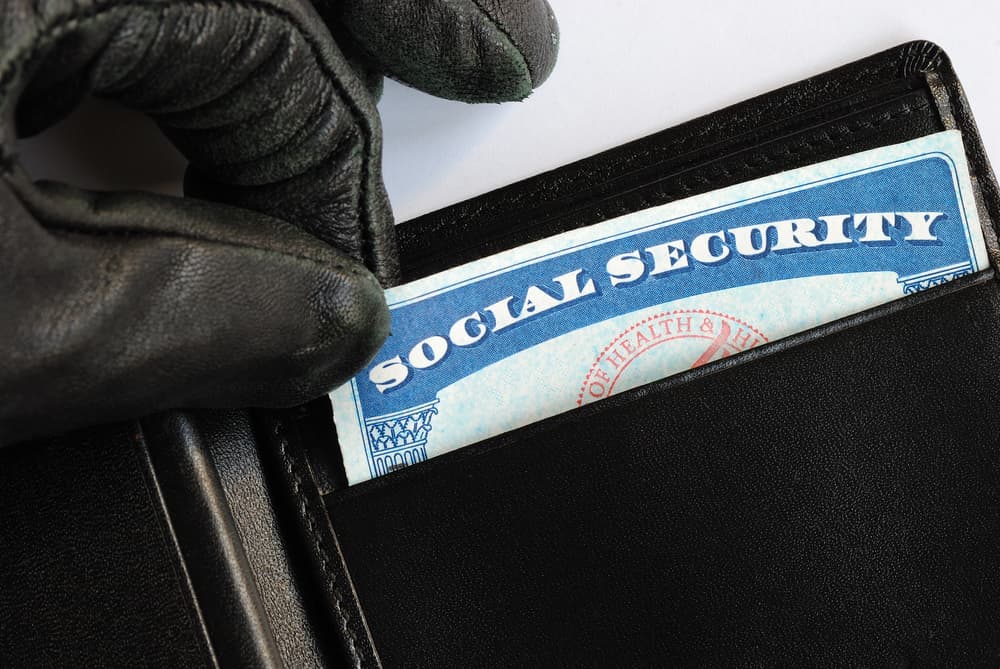

Credit identity theft occurs when someone uses your personal information, such as your name, Social Security number, or credit card number, to open new credit accounts or make unauthorized charges on your existing accounts. This can include opening new credit cards, taking out loans, or even renting an apartment or buying a car in your name.

Identity thieves may obtain your personal information by:

- Stealing your wallet or purse containing your credit cards and identification

- Hacking into your computer or mobile device to access your financial accounts

- Tricking you into revealing your personal information through phishing scams or fake websites

- Stealing your mail or digging through your trash to find discarded credit card offers or bank statements

Once an identity thief has your personal information, they can use it to open new accounts or make charges on your existing accounts without your knowledge or consent.

This can lead to a host of problems, including damage to your credit score, difficulty obtaining credit in the future, and even legal trouble if the thief uses your information to commit other crimes.

How Credit Identity Theft Can Lead to Debt Collection

One of the most serious consequences of credit identity theft is the potential for debt collection. When an identity thief opens new accounts or makes unauthorized charges in your name, they essentially create debt that you must pay.

If you don't discover the theft quickly and take steps to dispute the charges, you may find yourself on the hook for thousands of dollars in fraudulent debt.

Even if you do discover the theft and report it to the credit bureaus and your creditors, the process of resolving the issue and removing the fraudulent accounts from your credit report can take months or even years

Meanwhile, the creditors may continue to try to collect on the debt, either by contacting you directly or by hiring a debt collection agency.

Debt collection can be a stressful and intimidating process, especially if you are dealing with fraudulent debt that you didn't create. Debt collectors may use aggressive tactics to try to get you to pay, such as calling you repeatedly, sending threatening letters, or even suing you in court.

If you don't respond to the debt collector's attempts to contact you or if you fail to pay the debt, they may report the delinquency to the credit bureaus, further damaging your credit score.

What to Do if You Are a Victim of Credit Identity Theft

If you suspect that you are a victim of credit identity theft, act quickly to minimize the damage and protect your finances.

Here are some steps you can take:

- Contact the credit bureaus: If you suspect that someone has opened fraudulent accounts in your name, contact the three major credit bureaus (Equifax, Experian, and TransUnion) and place a fraud alert on your credit report. This will make it more difficult for the thief to open new accounts in your name and will notify you if someone tries to do so.

- Review your credit report: Once you have placed a fraud alert on your credit report, request a copy of your credit report from each of the three bureaus. Review the report carefully for any accounts or transactions that you don't recognize, and report any fraudulent activity to the credit bureaus and your creditors.

- File a police report: If you have evidence of credit identity theft, such as unauthorized charges on your credit card statement or a bill for an account you didn't open, file a police report with your local law enforcement agency. This will create an official record of the crime and may be necessary to dispute the fraudulent accounts with your creditors.

- Contact your creditors: If you find fraudulent accounts or transactions on your credit report, contact the creditors immediately to dispute the charges and close the accounts. You may need to provide a copy of the police report and other documentation to prove that you are a victim of identity theft.

- Consider a credit freeze: If you are concerned about further identity theft, you may want to consider placing a credit freeze on your credit report. This will prevent anyone from opening new accounts in your name, even if they have your personal information.

Dealing with Debt Collection

If you are a victim of credit identity theft and are facing debt collection as a result, talk to a lawyer to learn your rights and protect yourself. Here are some tips for dealing with debt collectors:

Dispute the Debt

If you believe that a debt is fraudulent and was created through identity theft, dispute the debt with the debt collector as soon as possible. This means contacting the collector in writing and providing evidence that the debt is not legitimate.

When disputing a debt, include as much information as possible, including:

- Your name and contact information

- The name of the creditor and the account number associated with the debt

- A statement that you are disputing the debt and that you believe it is the result of identity theft

- Copies of any documentation you have to support your claim, such as a police report or evidence of the identity theft

Keep copies of all correspondence with the debt collector, as well as any documentation you provide. You may also want to send your dispute letter by certified mail with return receipt requested, so you have proof that the collector received it.

Once the debt collector receives your dispute, the law requires them to investigate the claim and provide evidence that the debt is legitimate. If they cannot do so, they must stop all collection efforts and remove the debt from your credit report.

If the debt collector continues to try to collect the debt or reports it to the credit bureaus after you have disputed it, they may violate the Fair Debt Collection Practices Act (FDCPA), and you may have grounds for legal action.

Request Validation

Under the FDCPA, you may demand validation of any debt that a collector is trying to collect from you. This means that the collector must provide proof that you owe the debt and that they have the legal right to collect it.

To request validation, send a written request to the debt collector within 30 days of receiving their initial communication. The request should include:

- Your name and contact information

- The name of the creditor and the account number associated with the debt

- A statement that you are requesting validation of the debt

- A request for the name and address of the original creditor, if different from the current creditor

Once the debt collector receives your validation request, they must provide you with written verification of the debt, including:

- The name and address of the original creditor

- The amount of the debt

- A statement that the debt is valid and that you owe it

- Proof that they have the legal right to collect the debt, such as a copy of the original contract or a court judgment

If the debt collector cannot provide this validation, they must stop all collection efforts and remove the debt from your credit report. If they continue to try to collect the debt without providing validation, they may violate the FDCPA, and you may have grounds for legal action.

Requesting validation does not make the debt go away if it is legitimate. However, it can ensure that they don’t demand that you pay a debt that you don't actually owe or that the collector has the legal right to collect.

Seek Legal Help

If you are a victim of credit identity theft and a debt collector sues you for a fraudulent debt, seek legal help immediately. An experienced attorney on your side can make a big difference in the outcome of your case.

A consumer protection or debt collection defense attorney can help you by:

- Reviewing the lawsuit and any evidence the collector has provided to determine if the debt is legitimate

- Filing a response to the lawsuit and representing you in court proceedings

- Negotiating with the debt collector to try to reach a settlement or have the case dismissed

- Advising you of your rights and options throughout the legal process

- Helping you to counter-sue the collector if they have violated the FDCPA or other consumer protection laws

When choosing an attorney, look for someone who has experience in handling cases like yours and who you feel comfortable working with. You may want to ask for referrals from friends or family members or contact your local bar association for a list of attorneys.

Legal help can protect your rights and fight back against fraudulent debt collection practices. An experienced attorney can provide valuable guidance and representation throughout the legal process and help you achieve the best possible outcome in your case.

Preventing Credit Identity Theft

You can take to prevent identity theft from happening in the first place if you:

- Protect your personal information: Be cautious about sharing your personal information, such as your Social Security number or credit card number, with others. Don't carry your Social Security card in your wallet, and shred any documents that contain personal information before disposing of them.

- Use strong passwords: Use strong, unique passwords for all of your online accounts, and consider using a password manager to help you keep track of them. Enable two-factor authentication whenever possible for an extra layer of security.

- Monitor your credit: Regularly review your credit report and credit card statements for any suspicious activity. Consider signing up for a credit monitoring service that can alert you to any changes in your credit report.

- Be wary of phishing scams: Be cautious about clicking on links or downloading attachments from unsolicited emails or texts, as these may be phishing scams designed to steal your personal information. If you receive a suspicious message, contact the company directly using a phone number or email address you trust.

- Protect your mail: Collect your mail promptly and place a hold on your mail if you will be away from home for an extended period of time. Consider using a locked mailbox or post office box to prevent mail theft.

Contact a Consumer Protection Attorney

Credit identity theft is a serious problem that can lead to a host of financial and legal problems, including debt collection. If you are a victim of credit identity theft, act quickly to minimize the damage and protect your finances. By contacting the credit bureaus, filing a police report, and disputing any fraudulent accounts or transactions, you can take steps to resolve the issue and prevent further harm.

If you are facing debt collection as a result of credit identity theft, remember that you have rights under the FDCPA and other consumer protection laws. Don't be afraid to assert your rights and seek legal help if necessary.

If you face debt collection due to credit identity theft, don't hesitate to seek help.

Contact the credit bureaus, your creditors, and local law enforcement, and consider seeking the advice of a California consumer protection attorney. With the right knowledge and resources, you can protect yourself and your finances from the damaging effects of credit identity theft.