Credit identity theft is a serious problem that affects millions of Americans every year, and San Diego is no exception. In 2020, the Federal Trade Commission (FTC) received nearly 1.4 million reports of identity theft, which is about twice as many as in 2019.

Of these reports, 406,375 came from people who said someone misused their information to apply for a government document or benefit, such as unemployment insurance.

Credit identity theft can have devastating consequences for your financial well-being, including damage to your credit score, difficulty obtaining credit, and even legal troubles.

In this blog, we'll explore what credit identity theft is, how it happens, and, most importantly, what you can do to prevent it from happening to you in San Diego.

What is Credit Identity Theft?

Credit identity theft occurs when someone uses your personal information, such as your name, Social Security number, or credit card number, to open new credit accounts or make purchases without your permission.

This can include opening new credit cards, taking out loans, or even renting an apartment or buying a car in your name.

Identity thieves may obtain your personal information in a variety of ways, including:

- Stealing your wallet or purse containing your identification and credit cards

- Hacking into your computer or mobile device to access your financial accounts

- Tricking you into revealing your personal information through phishing scams or fake websites

- Stealing your mail or digging through your trash to find discarded credit card offers or bank statements

Once an identity thief has your personal information, they can use it to wreak havoc on your credit report and financial life.

They may rack up large balances on credit cards or loans in your name, leaving you on the hook for the debt. They may also use your information to create fake identification documents or even commit other crimes in your name.

The Impact of Credit Identity Theft

Credit identity theft can have a significant impact on your financial well-being, both in the short-term and long-term.

Some of the ways that credit identity theft can affect you include:

Damage to Your Credit Score

One of the most significant impacts of credit identity theft is the damage it can do to your credit score. Your credit score is a three-digit number that reflects your creditworthiness. Lenders, landlords, and even employers use it to evaluate your financial responsibility.

When identity thieves open new accounts or make purchases in your name, it can lead to missed payments, high balances, and even collections accounts on your credit report. These negative items can significantly damage your credit score, making it harder to obtain credit in the future.

For example, a single missed payment can cause your credit score to drop by up to 100 points, while a collections account can remain on your credit report for up to seven years. The more negative items on your credit report, the lower your credit score.

A damaged credit score can have a ripple effect on your financial life, making it harder to:

- Obtain a mortgage or rent an apartment

- Get approved for a car loan or credit card

- Secure a job or promotion

- Qualify for favorable interest rates or insurance premiums

In some cases, a damaged credit score can even lead to higher utility deposits or difficulty obtaining a cell phone contract.

Repairing the damage to your credit score after identity theft may involve disputing fraudulent accounts and transactions with the credit bureaus, working with creditors to remove negative items from your report, and even seeking legal assistance to clear your name.

The best way to protect your credit score from the damage of identity theft is to monitor your credit report and take steps to secure your personal information. By catching fraudulent activity early and taking swift action to resolve it, you can minimize the impact on your credit score and financial well-being.

Difficulty Obtaining Credit

Another significant impact of credit identity theft is the difficulty it can create in obtaining credit when you need it. When fraudulent activity damages your credit score, it can make it much harder to get approved for loans, credit cards, and other forms of credit.

For example, if you're applying for a mortgage, a damaged credit score can lead to higher interest rates, larger down payment requirements, or even denial of your application altogether. Similarly, if you're applying for a car loan or credit card, a low credit score can result in less favorable terms or a higher likelihood of rejection.

The impact of credit identity theft on your ability to obtain credit can be particularly frustrating if you have a history of responsible credit use and have worked hard to build a strong credit profile. Through no fault of your own, you may find yourself unable to access the credit you need to achieve your financial goals.

In addition to the immediate impact on your ability to obtain credit, credit identity theft can also have long-term consequences for your financial future. A damaged credit score can take years to repair, and in the meantime, you may miss out on opportunities to buy a home, start a business, or pursue other financial goals.

To minimize the impact of credit identity theft on your ability to obtain credit, protect your personal information and monitor your credit report regularly. If you do become a victim of identity theft, act quickly to report the fraud to the appropriate agencies and work with creditors to remove fraudulent accounts and transactions from your credit report.

Legal Troubles

In some cases, credit identity theft can lead to legal troubles that can be both stressful and costly to resolve. This can happen when identity thieves use your personal information to commit other crimes, such as fraud or even violent offenses.

For example, if an identity thief uses your information to open a bank account and then writes bad checks or engages in other fraudulent activities, you may need to pay for their actions. Similarly, if an identity thief uses your information to commit a violent crime or traffic violation, you could face legal consequences and even criminal charges.

Even if you are ultimately able to prove that you were not responsible for the crimes committed in your name, the legal process can be time-consuming, expensive, and emotionally draining. You may need to hire a lawyer, attend court hearings, and provide evidence to clear your name.

In addition to the immediate legal consequences, credit identity theft can also have long-term impacts on your legal record and reputation. A criminal record, even if it results from identity theft, can make it harder to find employment, housing, or even volunteer opportunities.

To protect yourself from the legal consequences of credit identity theft, it's important to be vigilant in monitoring your personal information and responding quickly to any signs of fraudulent activity.

This may include:

- Regularly reviewing your credit report and financial statements for unauthorized accounts or transactions

- Placing a fraud alert or credit freeze on your credit report if you suspect you may be a victim of identity theft

- Filing a police report and contacting the appropriate government agencies if you discover fraudulent activity in your name

- Working with a qualified attorney who specializes in identity theft and fraud cases to protect your legal rights and clear your name

By taking proactive steps to prevent and respond to credit identity theft, you can minimize the risk of legal troubles and protect your reputation and future prospects.

Time and Money Spent Resolving the Issue

One of the most frustrating aspects of credit identity theft is the time and money it can take to resolve the issue and restore your credit and financial well-being. Depending on the severity of the theft and the extent of the damage, the process of recovering from credit identity theft can take months or even years.

Some of the time-consuming tasks that may be involved in resolving credit identity theft include:

- Contacting creditors and financial institutions to report fraudulent accounts and transactions

- Disputing errors and fraudulent items on your credit report with the credit bureaus

- Filing police reports and affidavits to document the theft and establish your identity

- Working with government agencies, such as the Federal Trade Commission or the Social Security Administration, to report the theft and protect your identity

- Attending court hearings or legal proceedings related to the theft

- Monitoring your credit report and financial accounts for signs of ongoing fraudulent activity

In addition to the time involved, resolving credit identity theft can also be expensive.

Some of the costs that may be associated with the process include:

- Legal fees for hiring an attorney to assist with the recovery process

- Fees for credit monitoring or identity theft protection services

- Costs associated with obtaining copies of your credit report and other financial documents

- Lost wages or income due to time taken off work to deal with the theft

- Fees for replacing stolen identification documents, such as a driver's license or passport

While some of these costs may be covered by identity theft insurance or reimbursed by financial institutions, others may fall on the victim to bear. The financial burden of credit identity theft can challenge those who are already struggling to make ends meet.

To minimize the time and money spent resolving credit identity theft, it's important to act quickly and decisively when you suspect fraudulent activity. The sooner you report the theft and begin the recovery process, the less damage the thieves can do, and the faster you may restore your credit and financial well-being.

It's also important to be organized and persistent in your efforts to resolve the issue. Keep detailed records of all contacts with creditors, credit bureaus, and government agencies, and follow up regularly.

Finally, consider seeking the assistance of a qualified credit counselor or attorney who focuses on identity theft and fraud cases. A lawyer can provide valuable guidance and support throughout the recovery process and help you resolve the legal and financial issues involved.

How to Prevent Credit Identity Theft in San Diego

Here are some tips to help you protect your personal information and avoid credit identity theft:

1. Monitor Your Credit Report

Regularly monitor your credit report. You are entitled to one free credit report from each of the three major credit bureaus (Equifax, Experian, and TransUnion) every 12 months. You can request your free credit reports at www.annualcreditreport.com.

When you receive your credit reports, review them carefully for any accounts or transactions that you don't recognize. If you find any errors or suspicious activity, contact the credit bureau and the creditor immediately to dispute the information and take steps to protect your credit.

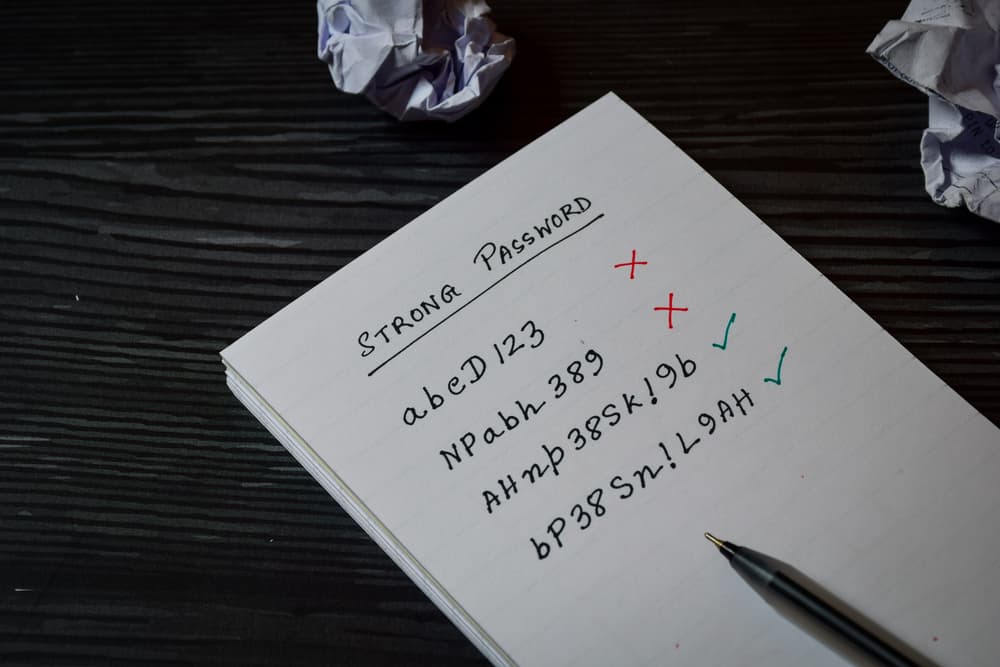

2. Use Strong and Unique Passwords

Another important step in preventing credit identity theft is to use strong and unique passwords for all of your online accounts. Avoid using easily guessable information, such as your birthdate or pet's name, and instead use a combination of upper and lowercase letters, numbers, and special characters.

It's also important to use different passwords for each of your accounts rather than using the same password across multiple sites. This can prevent a data breach at one company from compromising all of your accounts.

3. Be Cautious About Sharing Personal Information

Identity thieves are always looking for ways to trick people into revealing their personal information, so:

- Don't give out your Social Security number unless absolutely necessary, and never share it over email or text message.

- Be wary of unsolicited phone calls or emails asking for personal information, even if they claim to be from a legitimate company or government agency. If you're unsure, hang up and contact the company directly using a phone number or email address you trust.

- Don't click on links or download attachments from unfamiliar sources, as these may contain malware or phishing scams designed to steal your information.

- Shred or destroy any documents containing personal information before throwing them away, such as credit card offers or bank statements.

4. Use Credit Monitoring Services

Another way to prevent credit identity theft is to use credit monitoring services that can alert you to any suspicious activity on your credit report. These services typically monitor your credit report for any new accounts or inquiries and can send you alerts if anything unusual is detected.

Some credit monitoring services also offer additional features, such as identity theft insurance or credit score tracking. While these services can prevent credit identity theft, read the fine print and understand what you're signing up for before enrolling.

5. Freeze Your Credit

If you're not planning on applying for new credit in the near future, you may want to freeze your credit with each of the three major credit bureaus. A credit freeze prevents anyone from accessing your credit report without your permission, making it much harder for identity thieves to open new accounts in your name.

To freeze your credit, you'll need to contact each credit bureau separately and provide proof of your identity. There may be a small fee associated with freezing your credit, but it's often waived if you've been a victim of identity theft in the past.

6. Be Careful with Public Wi-Fi

When using public Wi-Fi networks, such as at a coffee shop or airport, be cautious about accessing sensitive information or making financial transactions. Public Wi-Fi networks are often unsecured and can be easily hacked by identity thieves looking to steal your personal information.

If you do need to access sensitive information while on public Wi-Fi, consider using a virtual private network (VPN) to encrypt your data and protect your privacy.

7. Stay Informed

Finally, one of the best ways to prevent credit identity theft in San Diego is to stay informed about the latest scams and tactics used by identity thieves. Follow reputable sources of information, such as the Federal Trade Commission or the San Diego District Attorney's Office, to stay up-to-date on the latest threats and learn how to protect yourself.

You can also attend local workshops or seminars on identity theft prevention or consult with a qualified attorney or financial advisor who specializes in credit and identity theft issues.

Contact a Consumer Protection Lawyer

As a San Diego resident, stay informed and vigilant about the risks of credit identity theft. By following the tips outlined in this blog post and staying up-to-date on the latest threats and scams, you can help protect yourself and your financial future.

If you're concerned about your risk of credit identity theft or have questions about your legal rights and options, don't hesitate to seek the guidance of a qualified attorney focusing on consumer protection and credit law. With the right information and support, you can take control of your credit and avoid becoming a victim of this serious crime.